draftkings tax form canada

If it turns out to be your lucky day and you take home a net profit of 600 or more for the year playing on websites such as DraftKings and FanDuel the organizers have a legal obligation to send both you and the IRS a Form 1099-MISC. DraftKings was one of nine operators recently recommended for mobile licenses in New York.

Draftkings Fanduel Players Fight Repayment Of Credit Card Bets Thestreet

I recently deposited about 50 in DraftKings and have grown that amount to around 800 mostly luck.

. What if there are no losses. Draftkings has this written regarding taxes. Do Canadians still pay the 30 and include it.

Players who believe that funds held by or their accounts with DraftKings Inc. Please advise as to where I input this other income that is not considered gambling however it was gambling winnings. Once you are logged in click on your name in the top right and go to My Account from the drop-down box.

The right to take bets in one of the countrys most populous states comes at a hefty pricea 51 tax on revenue higher than any other jurisdiction Arizona for example is 8Some have publicly doubted whether any operator. There is no requirement to file a US tax return. W9 forms are a common form generally sent out to independent contractors freelancers versus employees and many other situations where you have earned income.

This is calculated by the approximate value as prizes won - entry feesbonuses. After some doing research on my own is it correct that I will be taxed on the gain of each individual win. So if I have 1200 in wins but 400 in losses I will be taxed on the 1200 unless I itemize on my taxes.

1099-K from Paypal and I dont have a business. You do have to pay taxes on your Cumulative Net Profit from fantasy sports. When you fill out the DraftKings or FanDuel W9 form you will be required to submit your full name or business name tax classification ie.

If you receive your winnings through PayPal the reporting form may be. DraftKings will remit 24 of your net profit if it is over 600. However you still have to report the winnings on your Federal tax return.

However in many instances this withholding tax can be refunded. However thanks to a tax treaty between Canada and the United States Canadians can file a tax return and reclaim some or. Fantasy sports winnings of at least 600 are reported to the IRS.

Canadians using DraftKings for DFS are also subject to tax on their winnings. You could receive an inquiry for not reporting the income or for the. Have been misallocated compromised or otherwise mishandled may register a complaint with DraftKings Inc.

This is the email that players have reported receiving since early February an email that was received on Friday indicates that players should receive them within the next 1-2 weeks via mail. Draftkings support asking me to provide an IRS form for non Us tax payer and to consult with a US tax adviser This is my first time making a relatively big withdrawal Im asking fellow Canadians who live in Canada and successfully made withdrawal from Draftkings how to. Currently only very restrictive forms of sports betting are allowable most notable that you are only able to place parlay bets rather than wagers on single.

New Yorks 51 Tax. DraftKings is required to issue 1099 tax forms to any player who has a cumulative net profit in excess of 600 for the calendar year. Similar to gambling winnings if a player collects over 600 from daily fantasy sports in a tax year they will receive a 1099-MISC form in the mail to report that income.

I received a 1099-misc from Draftkings and they deducted 30. In recent months there has been a lot of talk among lawmakers in Canada about allowing single-event sports betting. DraftKings Preparing For Potential Legal Sports Betting in Canada.

Whether you report it or not you need to be sure you keep detailed records of the back and forth of that 42K. If you dont report make sure you can trace the money to show you had a net loss or at least no income to report. DraftKings 1099 Forms havent arrived and its causing some players to inquire about the delay.

And you are subject to income taxes said TaxAct. Steps to Retrieve Your DraftKings 1099 Forms. The only place I see where a 1099-MISC is applicable is Small Business Self employed which is not what my DRAFTKINGS form is from.

DFS Taxes in Canada. Individualsole proprietor C Corp S Corp etc address. Once on this page you see a variety of account-related items.

Draftkings Sportsbook Promo Code 1 050 Free Bonus April 2022

Is Draftkings Legal In California We Provide A Legal Overview

Draftkings Daily Fantasy Sports 500 Bonus On Dfs Basketball Insiders Nba Rumors And Basketball News

Draftkings Fanduel Legal States Where Is Dfs Allowed

Draftkings Settles Proxy Sports Betting Dispute In New Jersey

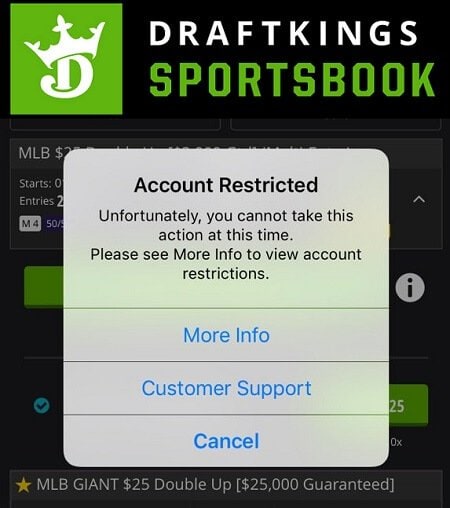

Restore Restricted Or Locked Draftkings Sportsbook Account

Draftkings Sportsbook Promo Code 1 050 Free Bonus April 2022

Draftkings Canada Ontario Sportsbook App Promo Code

Draftkings Colorado Promo Code 1 050 Sportsbook Bonus

Draftkings New York Promo Nfl Conference Championship Offe

Draftkings Begins New Era With Official Launch Of Sportsbook In New Jersey Business Wire

Draftkings To Pay 325k In Class Action Settlement Top Class Actions

Is Draftkings Legal Is Playing On Draftkings Sportsbook Dfs Legal

Draftkings Sportsbook Promo Code 1 050 Free Bonus April 2022

Fanduel And Draftkings Winnings By Canadian

Draftkings Louisiana Online Sports Betting Launches Tomorrow

Best Daily Fantasy Betting Sites Get 1000s In Bonuses And Free Play